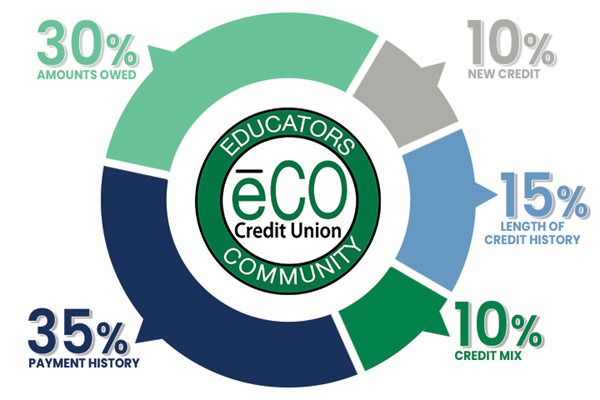

In a previous blog, we defined credit score, but now, it’s time to talk about how your credit score is calculated. Your FICO® Score is calculated using a variety of data from your credit report.

Payment History- 35%

Payment history is the biggest factor in determining your credit score. Payment history shows if you have paid your credit accounts on time. It includes payment information on credit cards, installment loans, retail accounts (credit from stores where you shop, including department store cards), mortgages, and other accounts. If you are or have been delinquent on a credit account, your report will show how overdue you were. Making your payments on time has a major impact on increasing or maintaining a good credit score.

Pro-tip: include all debt payments in your monthly budget. You must pay your bills and pay them on time to build or maintain a good credit score.

Amounts Owed- 30%

Amounts owed or capacity is how many debts you have in total. If you are maxing out your available credit, it may show you are overextended, making it harder to pay your debts. There are a few factors that are considered when looking at capacity:

- The amount owed on all accounts

- How much do you owe on all of your credit accounts?

-

Pro-tip: even if you pay credit card balances in full each month, your credit report might reflect a balance, depending on when the information was reported to the credit bureau.

- The number of accounts with balances

- Do you owe balances on a large number of accounts?

- The amount of issued credit you’re using

- Are you maxing out your credit cards?

- Let’s say you have a credit card with a limit of $5,000. If you have $2,500 charged on the card, you are using 50% of the issued credit.

-

Pro-tip: You should work to keep the amount of issued credit you’re using under 50%.

Length of Credit History- 15%

The length of time you’ve been using credit is also taken into consideration when determining your credit score. Typically, a longer credit history will improve your score. How long your credit accounts have been established and how long since you’ve used certain accounts are considered when looking at the length of your credit history.

Pro-tip: it’s generally a good idea to leave your first credit card or line of credit open, even if you no longer regularly use it. It can help boost your length of credit.

New Credit- 10%

When building your credit score, you want to be sure you don’t open too many accounts at the same time. It’s also important to not have too many inquiries on your credit report. An inquiry occurs when someone pulls your credit; even if you don’t finance with the lender, the inquiry will remain on your report for two years.

Pro-tip: accessing your credit report from the three major bureaus will not show up as an inquiry. We encourage you to request a free credit report every year from each of the major credit bureaus. Learn more in the Understanding Your Credit blog.

Credit Mix- 10%

Credit mix is the different types of credit you utilize. It’s good to have a mix of revolving and installment accounts.

- Revolving accounts set a credit limit (a maximum you can spend on the account). You can choose to pay the balance in full or carry it over from one month to the next. The amount owed can fluctuate based on your usage and payments each month. Some examples of revolving accounts are:

- Installment accounts typically require a fixed payment each month until the balance is paid in full. A few examples are:

Pro-tip: if you’re looking to add something to your credit mix simply to improve your score, be sure to consider the risk versus the reward. Remember, new credit and credit inquiries can have a negative impact on your score if you take on too much debt at one time.

Be sure to check back soon for our next blog in the credit series. We’ll discuss how to improve and build your credit score.